Time to Talk Taxes

In the immortal words of Benjamin Franklin: “In this world nothing can be said to be certain, except death and taxes." We wish you all long and prosperous lives, so we’ll only be discussing your taxes today.

In the immortal words of Benjamin Franklin: “In this world nothing can be said to be certain, except death and taxes." We wish you all long and prosperous lives, so we’ll only be discussing your taxes today.

It’s tax season. Now is the time to start organizing your tax documents and consulting with your accountant or tax preparer. We’ll let you know by email when all your important tax documents will be available. Depending on how you set your delivery method, you’ll receive them via regular mail or email. You will also be able to find your tax documents online.

A few tips:

• Locate your tax documents by logging into your account and going to “My Accounts > E-documents > Tax Documents” page

• You can easily import your consolidated 1099 into TurboTax

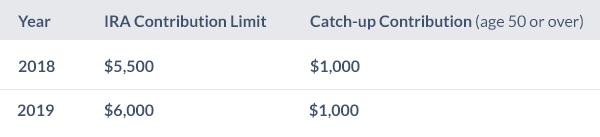

• Remember to make your IRA contribution by April 15, 2019. Take advantage of increased contribution limits

We know that this can be a stressful time for many of you, so we’ve put together some Frequently Asked Questions with more details and key dates to help you get your ducks in a row. Of course, if you have additional questions, the Firstrade team is always ready to help.

Let’s Talk About ETFs

There are thousands of Exchange Traded Funds (ETFs) to choose from to help round out your portfolio. At Firstrade, all of our ETFs are commission free and we make it easier to select the right ones for you.

There are thousands of Exchange Traded Funds (ETFs) to choose from to help round out your portfolio. At Firstrade, all of our ETFs are commission free and we make it easier to select the right ones for you.

In the current market, ETFs — baskets of stocks, bonds or commodities — have become increasingly valuable investment tools for self-directed investors seeking greater portfolio diversification, reduced risk, increased flexibility and tax efficiency through exchange-traded investing. Investors can choose from a wide array of funds in virtually any sector, industry or asset class.

There are many ways to learn about ETFs, including published articles that provide an objective view. Recently, Kiplinger’s Personal Finance analyzed 20 ETFs that could help you decide what works for you.

Ready to add ETFs to your portfolio? Learn more about our commission-free ETFs here.

It’s easy to rollover your old 401(k)

If you left your wallet in an Uber with $500 in it, wouldn’t you try to get it back? Turns out that’s not what many millennials are doing when they switch jobs.

If you left your wallet in an Uber with $500 in it, wouldn’t you try to get it back?

Turns out that’s not what many millennials are doing when they switch jobs.

The strongest job market in decades, ironically, can actually be having a negative impact on people’s retirement savings, especially millennials. Money in 401(k) plans sits idle as people move on to new job opportunities. According to a recent study, 59 percent of millennials between the ages of 25 and 34 with tens of thousands of dollars saved had at least one 401(k) at a previous employer. The same was true for 41 percent of investors overall.

Leaving money on the table is not something millennials like to do. They are conscientious about their money, yet many find it a hassle to move their retirement savings with them.

After learning what is a rollover IRA, one solution is to move your funds from your 401(k) to a rollover IRA.. By directly rolling over assets from your employer-sponsored retirement plan into an IRA Rollover, you'll defer your tax liability and may be able to completely avoid penalties.

Firstrade offers Rollover IRAs with no fees: no annual fee, free account set-up and no maintenance fees. In addition, Firstrade has eliminated commissions for all stocks, options, mutual funds and ETFs, so you can trade stocks in your IRA for $0 a trade. It takes just minutes to open a new Firstrade account and about four to five business days to transfer funds via check from an existing 401(k) into a rollover IRA.

Just another reason millennials choose Firstrade.

You Win Because We Win

Accolades are always nice. They tell us we’re doing something well. So, if you will indulge us for a few minutes, we’d like to share with you some of the praise we’ve received from prestigious industry insiders this past year.

Accolades are always nice. They tell us we’re doing something well. So, if you will indulge us for a few minutes, we’d like to share with you some of the praise we’ve received from prestigious industry insiders this past year.

Foremost among the year’s highlights, Firstrade was selected by Kiplinger’s Personal Finance as one of the best online brokers of 2018 and was additionally honored as Best for ETF Investors and Best for Bond Investors. We were proud to share these honors with some of the largest and most well-known brokers in the industry including TD Ameritrade and Schwab.

For the fifth year in a row, Firstrade was also awarded 4.5 stars out of five for the website’s ease of use and also received 4.5 stars for its commissions and fees by StockBrokers.com 2018 Online Broker Review.

On August 23, 2018, right after our recognition from Kiplinger’s and Stockbrokers.com, Firstrade announced commission free trading of stocks, ETFs, options and mutual funds. Now that’s a big win for our customers.

According to Blain Reinkensmeyer, Head of Broker Research at StockBrokers.com, “Overall, Firstrade provides fantastic value with its offering of trader tools compared to its closest deep discount competitors. Investors looking for a low-cost, well balanced, all around easy-to-use broker will find Firstrade a great fit.”

Ok, ok, we know what you must be thinking— “they’re just showing off.” You’re right! But these are accomplishments we share with you—our loyal customer.

For us, these accolades are simply a reflection of the value and high-quality services you have come to expect from us. At Firstrade, you always trade for free and we’re proud to be providing you with the products, tools, technology, research and customer service you need to make sound investment decisions. It’s a commitment you’ll continue to be hearing about as we introduce new programs and services in 2019.

As always, we value your loyal patronage and welcome your comments and suggestions about making your Firstrade experience even better. Let us know how we’re doing and what you need from us to succeed.

The Firstrade Team

Welcome to Firstrade’s new blog, First Call.

First Call is the place to go for Firstrade news and events— to learn about new products and services and get tips on how to best use the Firstrade platform.

First Call is the place to go for Firstrade news and events— to learn about new products and services and get tips on how to best use the Firstrade platform. Whether you’re a frequent trader or have a long-term view, we’ll be talking about issues that impact your daily financial life, from retirement planning to how to be a smarter investor. First Call is all about you, your investing style and your financial goals.

Firstrade is the first and only online brokerage to offer free commissions for all stocks, options, mutual funds and ETFs. Our new blog will inform and educate you about the many ways in which Firstrade supports the self-directed investor.

We have many great posts to share with you and are excited to get started. Stay tuned.