9 Retirement Planning Milestones By Age

When I get older, losing my hair, many years from now …. Will you still need me, will you still feed me, when I’m 64?

When Paul McCartney wrote those wonderful words, was he thinking about retirement? Hardly. But in thinking about your retirement, whether you are 24 or 64, there are certain age milestones that you should be aware of when planning for your retirement. Learn the 9 retirement planning milestones you should hit below.

When I get older, losing my hair, many years from now …. Will you still need me, will you still feed me, when I’m 64?

When Paul McCartney wrote those wonderful words, was he thinking about retirement? Hardly. But in thinking about your retirement, whether you are 24 or 64, there are certain age milestones that you should be aware of when planning for your retirement. Learn the 9 retirement planning milestones you should hit below.

By the way, you should know that Firstrade offers absolutely no-fee rollover IRAs – both traditional and Roth – with no annual fee, free account set-up and no maintenance fees. And, since Firstrade has no commissions, you can trade in your IRA for free.

To learn more about Firstrade’s IRA offerings, click here.

Age 49 and Under: Save, Save, Save

When saving for your retirement, there is perhaps nothing more important than benefitting from the “magic” of compounding interest, so the younger you are when you start socking money away, the better. Roth IRA’s work best at this stage—pay taxes now at a lower rate, watch your investments grow tax-free for years.

Age 50: Increase Contribution Limits

Starting at 50, you can take advantage of an increased contribution limit for both your 401(k) and IRA. If you’re 50 or older you can make 401(k) catch-up contributions of up to $6,000, for a maximum 401(k) contribution of $25,000 in 2019. You can also deposit an extra $1,000 in an IRA, or $7,000, for 2019.

Age 59 ½: Withdrawals with No Penalties

You can start taking withdrawals from your 401(k) and IRA without penalty at age 59 ½. Before this age, you’re subject to a 10 percent early withdrawal penalty.

Age 62: First Year for Social Security Eligibility

This is the first year that you can begin collecting your Social Security payments. However, if you start taking your social security at this age, your monthly check will be significantly lower than if you wait a few more years. For example, if your full retirement age is 67 and you retire at 62, that will translate into about a 30% monthly reduction in benefits.

Age 65: First Year for Medicare Eligibility

Medicare eligibility begins at age 65. You can enroll during a seven-month period that starts three months before the month you turn 65. Make sure you enroll on time because your Medicare Part B premiums will increase by 10 percent for each 12-month period you were eligible for benefits but did not sign-up.

Age 66: Full Retirement Age for Many Baby Boomers

If you’re a baby boomer born between 1943 and 1954, you qualify for your full Social Security benefit at age 66. The Social Security full retirement age gradually increases from 66 and two months to 66 and 10 months if you’re born between 1955 and 1959.

Age 67: Full Retirement Age if Born 1960 or After

The Social Security full retirement age is 67 for workers born in 1960 or later. Once you reach your full retirement age, you can work while receiving Social Security benefits without having any of your payments withheld.

Age 70: If You can Wait, Do

You can increase your Social Security payments if you delay claiming your benefit between your full retirement age and age 70. This can provide you with a significant bump in your Social Security-- payments increase by 8 percent for each year you wait to start your payments. There is no additional benefit to waiting for your Social Security after age 70, so sign up!

Age 70 ½: Required Withdrawals

When you’re age 70 1/2 and older you’re no longer eligible for retirement plan tax deductions and are required to start taking annual withdrawals from 401(k)s and traditional IRAs and pay taxes on what you’ve taken out. The penalty for missing a required minimum distribution is a lot—50% of the what you should have withdrawn, so don’t miss this deadline!

So, there you have it. Pay attention to these age milestones and hopefully, you’ll be on your way to a comfortable retirement. Of course, if you have questions along the way, don’t hesitate to ask us!

New Free Trading App is Live!!

We’re thrilled to let you know that Firstrade’s newly redesigned and rebuilt trading app is live today!

We’re thrilled to let you know that Firstrade’s newly redesigned and rebuilt trading app is live today! Simply go to here to download the new app now to make trading and managing your account even easier and faster than ever.

The new Firstrade trading app takes virtually all the functionality of our great web platform and puts it on your smartphone. Our new design makes it fun to use with faster access to news, charts and trading tools.

We’re committed to providing you all the great benefits and full investment product line that you’ve grown accustomed to at Firstrade —all from the convenience of your smartphone. And, you’ll be able to take advantage of our personalized and responsive customer service— no auto responses at Firstrade!

The Firstrade app 3.0.2 is available for iOS devices today with an Android version to rollout soon.

At Firstrade, we’re making it simpler and more efficient for you to review and manage your account, monitor the market and trade whenever and wherever you want.

Here are some of the highlights:

· Swipe left to quickly Buy or Sell right from the Positions page or Watchlist

· Intuitive, user-friendly buy/sell interface enabling trades in seconds

· Transfer funds to and from your banking institution

· Charts can be converted to landscape mode with indicator overlays

· All single and multi-leg options strategies available

· Access to financial research, data and event calendars

· Real time market data and news feed

· Complete control over multiple accounts

· 8 AM to 8 PM extended hours trading

· Ability to open a no-fee IRA account

· Ability to instantly review portfolio dashboard

· All products and services consolidated in one account

Go to link here to sign up now! And let us know what you think.

Time to Pay the Piper

April 15, Tax Day, is just one week away. Have you saved for your retirement yet for 2018? Turns out, that most Americans won’t be making the most of their retirement years– ever.

April 15, Tax Day, is just one week away. Have you saved for your retirement yet for 2018? Turns out, that most Americans won’t be making the most of their retirement years– ever.

But there is good news. Firstrade’s absolutely no-fee traditional IRA and Roth IRA are completely free, take just minutes to open, and can support your retirement dreams – without paying the piper. We’ve written about the differences between a traditional IRA and a Roth IRA and the various ways in which you can save.

Since most of you are managing your own portfolio, it’s probably a good idea to review your retirement plan now. Using the “three legs” of the retirement stool – private savings, pensions and social security – what is the expected long-term outlook? Or if you’re a baby boomer, what’s your short-term outlook?

Examine your holdings in your mutual fund accounts and 401(k) plan. If you have an IRA, are you making the right investments, is your trajectory in sync with your retirement, are you making the most of your contribution limit?

If you have a pension plan, what is the expected payout? Will this be enough to live on? The median private pension was only $9,376 a year, according to the Pension Rights Center (state, local and federal pensions were higher). If you’re older, that might be nice to have, but if you’re a younger investor, it’s highly unlikely you will ever have a pension.

And finally, there’s social security. In 2018, the average Social Security check was $1,422 a month or $17,064 a year. That’s okay if you’ve paid off your home, have little or low expenses and live in a relatively less expensive part of the country. Again, if you’re young, social security might not be an option to rely on years from now.

So, do yourself a favor. Learn how to make the best of your retirement. Invest in a Firstrade no-fee IRA. Today.

Can I Open an IRA or a Roth IRA for My Child?

Our children want many things. Love. Security. Comfort. Toys. Clothes. A laptop. A car. A college education. Concert tickets. Their own room.

Did we not mention …. an IRA? Really, a no-fee IRA for your child?

Our children want many things. Love. Security. Comfort. Toys. Clothes. A laptop. A car. A college education. Concert tickets. Their own room.

Did we not mention …. an IRA? Really, a no-fee IRA for your child?

While your kids might not be too excited now, they almost certainly will when they’re older. Think about it, what a wonderful way to help your kids begin a lifetime of savings. And to watch that money, grow and grow over a long period of time.

If you were ever unsure if you can open an IRA for your children, the answer is yes. Your child must, however, have earned income to make contributions. You can choose to make contributions on your child’s behalf up to the amount of his or her income. Or better yet, you can also convince them to put away just a little of their own money and then match those contributions up to the annual contribution limit.

You may want to consider a Roth IRA, where contributions are made with after tax money. Since in all likelihood your children will never be in a lower tax bracket than they are now, you don’t have to worry about paying taxes upon withdrawal. Money in a Roth account can also be withdrawn tax-free and penalty-free before retirement, which means that it can be used to pay for college education down the road.

We’ve talked before about the many benefits of investing in an IRA in general, particularly when it comes to the magic of compounded interest working for you. It goes without saying then, but we will, that the younger you are when you start a no-fee IRA, the greater your savings will be over the years—more time for that magic to work longer and harder for you!

Invest in a no-fee IRA for your child today, what a wonderful gift to them. They may even appreciate it someday!

Go to our website to learn more about our no fee IRA accounts.

Selling Covered Calls: A Definitive and Practical Guide

Maximize the income on your portfolio with Firstrade’s $0 commission trades and Options Wizard’s covered call screener! Learn to generate a consistent income stream for the existing stocks in your portfolio by selling covered calls with this easy guide!

Maximize the income on your portfolio with Firstrade’s $0 commission trades and Options Wizard’s covered call screener! Learn to generate a consistent income stream for the existing stocks in your portfolio by selling covered calls with this easy guide! A covered call is the single most popular strategy to add income to your stock and ETF portfolio. This simple option strategy only requires 100 shares of a stock or ETF and selling a call option against it to generate yield. Effective in most market conditions and outlooks, this income strategy suitable for most investors. However, selecting the right expiration and strike price may seem daunting with so many options, see how Options Wizard eases this process!

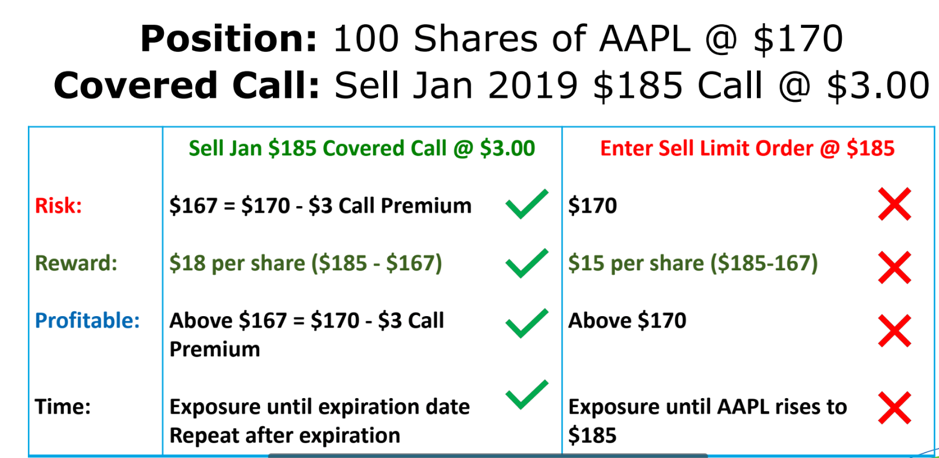

Covered Calls vs. Sell Limit Order

Imagine buying AAPL stock at $170/share and having a target price of $185. You have 2 options, place a sell limit order at $185 and wait, or sell a covered call with a $185 strike price. Selling a 1 month $185 strike call could generate an immediate income of $3 per share ($300 per 100 shares). Conversely, placing a limit order would not offer any income. Additionally, with the $3 income, your risk is reduced to $167 while your maximum gain is now increased to $18, instead of $15 with the limit order. Lastly, with a covered call, you have the opportunity to sell calls every month if the stock does not rise above the strike price, generating a consistent income stream! Example below:

Selecting the Right Strike Price

Selling a covered call obligates you to sell the stock at the strike price upon the expiration date. Just as a limit order would be placed at a price higher than the current price, the same methodology applies to selling a covered call. Covered calls should be sold with Out of the Money (OTM) strike prices. For example, if AAPL was trading at $170, an investor might want to sell a call option with a $185 strike. The higher the strike price, the less premium is paid to the seller as there is a lower probability of the stock price reaching the strike price before expiration. Picking a strike price that is close to the current price of the stock may be tempting with higher premiums, but the tradeoff is with limiting the gains on the underlying stock. This tradeoff is the main decision every investor must make when selecting a strike price for covered calls. Our research shows that a 20 Delta Call (20% chance of the stock being called away) provides a reasonable balance between income and upside gains for the underlying stock.

Managing Expiration Dates

Selling short term options (3-7 weeks) tend to provide better long-term returns. Short term option contracts have an advantage due to the ability to avoid earnings announcements. Additionally, shorter term options take advantage of accelerating time decay as an option approaches expiration. Longer term options simply do not offer the same yield for the same unit of time and typically have a higher probability of including an earnings announcement.

A Practical Application of Covered Calls

With any option strategy, manual selection of expiration and strike prices subjects’ an investor to mistakes and emotions that affect trading performance. The covered call is a strategy that yields the best results when a systematic approach is implemented. OptionsWizard is designed to automate the selection process to facilitate a systematic approach, increasing yields while reducing research time. Utilize OptionsWizard’s Income Settings to personalize your covered call preferences and allow OptionsWizard to find the covered calls to suit your needs. Simply select a time-frame (Short, Medium or Long) and risk-tolerance (Conservative, Optimal or Aggressive). Please view our full webinar on this topic to see this platform in action.

Summary

With covered calls, the goal is to hold the hold the trade until expiration and let the contract expire worthless. Therefore, it is important to pick a strike price and expiration that minimizes the risk of the stock reaching that price while maximizing the premium received. Once an option expires worthless, the covered call strategy can be repeated, and this generates a consistent stream of income from simply owning any stock or ETF. Utilize OptionsWizard to help you find the right balance between income and probability of selling your stock. Lastly, keep in mind that if your stock does get called away, this equates to a large gain in your underlying stock position and a profit taking opportunity!