Apple and Tesla stock split: How does it work and how will it affect me?

Both Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) recently announced that they are splitting their stocks on August 31, 2020.

Apple announced a 4-for-1 stock split while Tesla announced a 5-for1 stock split. If you own either of these stocks, you will see the split price automatically reflected in your investment account on August 31st – there is no action required on your part and Firstrade does not charge any fees for stock splits.

If you currently own Apple or Tesla stocks or plan to buy any soon, here’s what else you need to know:

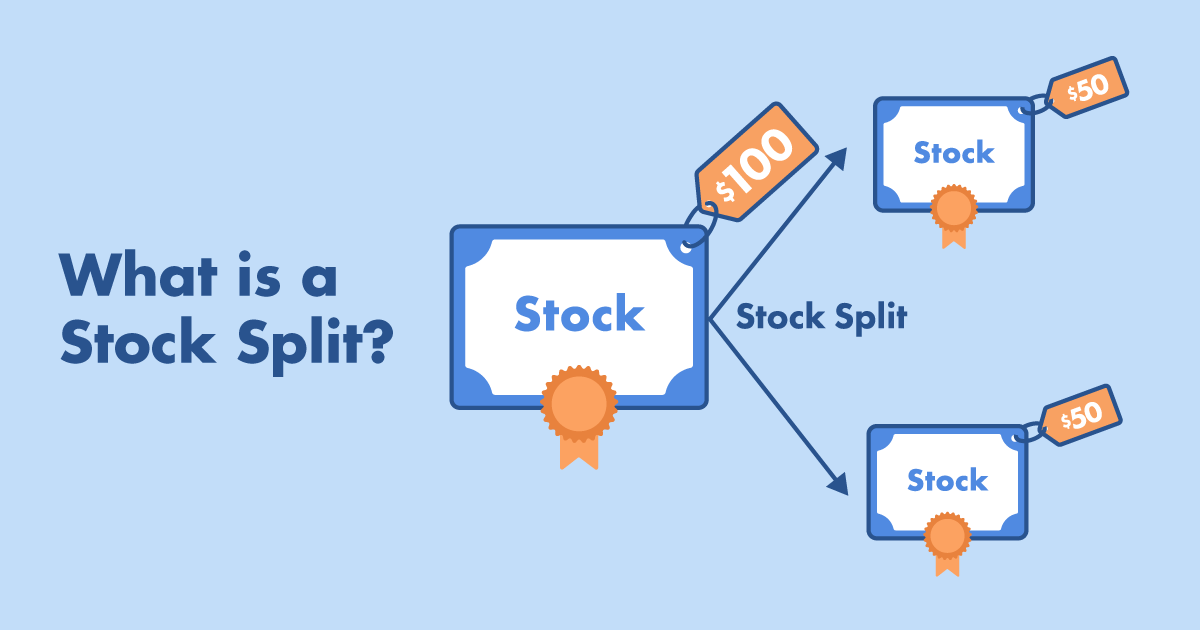

What is a stock split and how does it work?

A stock split is when a company decides to increase the number of its outstanding shares by dividing each share into multiple ones, reducing its stock price. This action doesn’t change the value of the company – just the price of its individual shares –which makes it more affordable for new investors to buy stocks in the company.

Take Apple (AAPL) as an example, for shareholders who already own Apple stocks, your original 1 share will become 4 shares, 2 shares will become 8 shares, and so on. The stock price will become 1/4 of the original price after the split, but its total market value would stay the same. Just like cutting an apple, no matter if you cut it into 4 or 8 slices, it will still be portions of the same apple.

Does the “record date” affect Apple or Tesla stocks in my account?

The record date of Apple (AAPL) has been marked as August 24 and Tesla (TSLA) as August 21. Regardless of the record date, all AAPL and Tesla shares you own before the market opens on August 31st will be entitled for the forward split share-allocation; you will own four shares of AAPL for every one share you hold, and five shares of TSLA for every one share you hold.

What will happen to the stocks in my account before and after the stock split?

Many people may be curious about what will happen if they choose to sell or buy the company’s stock before or after the stock split on August 31st. Let us again take Apple as an example, with $400/per share to illustrate the three scenarios that investors will encounter:

Scenario 1: If you hold Apple stock before the market opens on August 31st, it will be available to trade at the split price on August 31st.

The stock price per share after the split becomes ¼ of the original price. For example, if you have 10 Apple stocks valued at $400 per share, after the split, they will become 40 stocks valued at $100 per share. The total value of your Apple stock remains unchanged -- it’s still $4,000. After the market opens on August 31st, investors will be able to sell and buy Apple stocks at $100/per share.

Likewise, if you own one options call contract with a strike price of $500, after the split you would own four contracts controlling 100 shares each, at a $125 strike price.

Scenario 2: If you sell before August 31st, the stock you sold will be at the "pre-split" stock price.

Let’s say you sell Apple stock on August 28 (the last trading day before the split), you will be selling it at $400/per share instead of at $100 per share.

Scenario 3: If you buy Apple stock before August 31st, the stock you bought will be at the "pre-split" stock price.

If you buy 10 shares of Apple before August 31st, you will have 10 shares of Apple worth $400 per share in your account; on August 31st, due to the stock split, you will see Apple’s share price per share change from $400 to $100, and the number of shares you hold will change from 10 shares to 40 shares.