Recurring Contributions to Your IRA Make it Easier to Save for Retirement

Many of us have learned to automate parts of our lives to guard against our common proclivity to forget stuff, procrastinate and yes, succumb to sheer laziness.

Many of us have learned to automate parts of our lives to guard against our common proclivity to forget stuff, procrastinate and yes, succumb to sheer laziness.

Too busy to remember to pay that bill? Set up a monthly auto payment. It’s easy, efficient and you don’t even have to think about. Why not do the same with your retirement savings? Well, you can at Firstrade. Open an IRA account today.

Here’s how it works: decide to set aside a certain amount each month or quarter. If you’ve already set up ACH (if not, that’s easy too) in your IRA account, you can choose to make recurring contributions. That’s it, done. Of course, you can always change the amount of your contribution and the frequency whenever you want. The best part? When tax season comes around, you won’t have to worry about making a large contribution to max out.

Saving money for retirement can be hard enough. But if you can budget for your rent, monthly utilities and car payment, you can certainly make it a priority to budget for your retirement. It’s simple and seamless for you to save and take advantage of the many benefits that an IRA has to offer.

It’s easy, efficient and you don’t even have to think about.

For more information, please go to Firstrade website.

It’s never too soon to open an IRA

You’re young. You’re only on your second job but you’re doing well. You just moved into a great apartment downtown (ok, it’s with three other roommates). You finally have some spending money to spare.

You’re young. You’re only on your second job but you’re doing well. You just moved into a great apartment downtown (ok, it’s with three other roommates). You finally have some spending money to spare.

What to do? Buy that new car? Upgrade your high-tech stuff? Did anyone say, Bitcoin? What if we said, “how about opening an IRA?” Sounds exciting and cutting-edge, huh? “I’m young,” you say, “why should I worry about retirement now?”

But what if we told you, for argument’s sake, that investing just $400 a month in an IRA starting at age 25 will give you a retirement nest egg of $1.37 million at age 70 (assuming a 7% average annual return). If you begin at age 30, that will yield you $958,000 in retirement savings.

Wow, how does that happen? Through the magic of compounded interest. What’s that you ask? In simplest terms, it’s the interest on your interest and it’s the key to growing your money.… a lot over the years.

Of course, that was just one example. If $400 is too much, consider $100 or $200 a month, then start increasing the contributions as you earn more. It’s not hard to budget for retirement. Ordering in one less dinner meal per week ($10-$15) could save almost $800 per year, and bringing lunch to work one day a week ($5-$10) could save $260 to $520 a year. How hard is that?

And one more thing. Don’t expect Social Security to provide for your retirement years. Unless you want to severely cut back on your lifestyle, those benefits, while nice to have, just won’t be enough for most of you.

Firstrade makes it easy to open a commission free traditional or Roth IRA. Either way, don’t delay.

Click to get started.

Stay tuned.

Time to Talk Taxes

In the immortal words of Benjamin Franklin: “In this world nothing can be said to be certain, except death and taxes." We wish you all long and prosperous lives, so we’ll only be discussing your taxes today.

In the immortal words of Benjamin Franklin: “In this world nothing can be said to be certain, except death and taxes." We wish you all long and prosperous lives, so we’ll only be discussing your taxes today.

It’s tax season. Now is the time to start organizing your tax documents and consulting with your accountant or tax preparer. We’ll let you know by email when all your important tax documents will be available. Depending on how you set your delivery method, you’ll receive them via regular mail or email. You will also be able to find your tax documents online.

A few tips:

• Locate your tax documents by logging into your account and going to “My Accounts > E-documents > Tax Documents” page

• You can easily import your consolidated 1099 into TurboTax

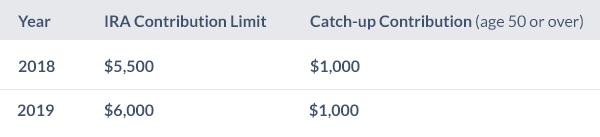

• Remember to make your IRA contribution by April 15, 2019. Take advantage of increased contribution limits

We know that this can be a stressful time for many of you, so we’ve put together some Frequently Asked Questions with more details and key dates to help you get your ducks in a row. Of course, if you have additional questions, the Firstrade team is always ready to help.

Let’s Talk About ETFs

There are thousands of Exchange Traded Funds (ETFs) to choose from to help round out your portfolio. At Firstrade, all of our ETFs are commission free and we make it easier to select the right ones for you.

There are thousands of Exchange Traded Funds (ETFs) to choose from to help round out your portfolio. At Firstrade, all of our ETFs are commission free and we make it easier to select the right ones for you.

In the current market, ETFs — baskets of stocks, bonds or commodities — have become increasingly valuable investment tools for self-directed investors seeking greater portfolio diversification, reduced risk, increased flexibility and tax efficiency through exchange-traded investing. Investors can choose from a wide array of funds in virtually any sector, industry or asset class.

There are many ways to learn about ETFs, including published articles that provide an objective view. Recently, Kiplinger’s Personal Finance analyzed 20 ETFs that could help you decide what works for you.

Ready to add ETFs to your portfolio? Learn more about our commission-free ETFs here.

It’s easy to rollover your old 401(k)

If you left your wallet in an Uber with $500 in it, wouldn’t you try to get it back? Turns out that’s not what many millennials are doing when they switch jobs.

If you left your wallet in an Uber with $500 in it, wouldn’t you try to get it back?

Turns out that’s not what many millennials are doing when they switch jobs.

The strongest job market in decades, ironically, can actually be having a negative impact on people’s retirement savings, especially millennials. Money in 401(k) plans sits idle as people move on to new job opportunities. According to a recent study, 59 percent of millennials between the ages of 25 and 34 with tens of thousands of dollars saved had at least one 401(k) at a previous employer. The same was true for 41 percent of investors overall.

Leaving money on the table is not something millennials like to do. They are conscientious about their money, yet many find it a hassle to move their retirement savings with them.

After learning what is a rollover IRA, one solution is to move your funds from your 401(k) to a rollover IRA.. By directly rolling over assets from your employer-sponsored retirement plan into an IRA Rollover, you'll defer your tax liability and may be able to completely avoid penalties.

Firstrade offers Rollover IRAs with no fees: no annual fee, free account set-up and no maintenance fees. In addition, Firstrade has eliminated commissions for all stocks, options, mutual funds and ETFs, so you can trade stocks in your IRA for $0 a trade. It takes just minutes to open a new Firstrade account and about four to five business days to transfer funds via check from an existing 401(k) into a rollover IRA.

Just another reason millennials choose Firstrade.