Get ready for a lot of IPOs this week.

The IPO market hasn’t been this busy since 2014, with 16 companies expected to launch their IPOs this week. Planned proceeds are anticipated to be around $7.8 billion, which will be the biggest week since May 2019 when Uber went public.

The IPO market hasn’t been this busy since 2014, with 16 companies expected to launch their IPOs this week. Planned proceeds are anticipated to be around $7.8 billion, which will be the biggest week since May 2019 when Uber went public.

The list includes Snowflake Inc. (SNOW), a cloud company with a proposed price range of $100 to $110 for its initial public offering. The company is planning to offer 28 million shares to raise up to $3.08 billion, which would make it the biggest deal of the year and the largest software IPO of all time. Here’s the full list of IPOs expected from Sept 16-18.

9/16/2020

Snowflake Inc. (SNOW)

Market: NYSE

Price: 100.00-110.00

Shares: 28,000,000

Offer Amount: $3,542,000,0000

JFrog Ltd (FROG)

Market: NASDAQ Global Select

Price: 39.00-41.00

Shares: 11,568,218

Offer Amount: $545,441,450.000

StepStone Group Inc. (STEP)

Market: NASDAQ Global Select

Price: 15.00-17.00

Shares: 17,500,000

Offer Amount: $342,125,0000

Metacrine, Inc. (MTCR)

Market: NASDAQ Global

Price: 12.00-14.00

Shares: 6,540,000

Offer Amount: $105,294,0000

9/17/2020

Alpha Healthcare Acquisition Corp. (AHACU)

Market: NASDAQ Capital

Price: 10.00

Shares: 10,000,000

Offer Amount: $115,000,0000

Dyne Therapeutics, Inc. (DYN)

Market: NASDAQ Global

Price: 16.00-18.00

Shares: 10,300,000

Offer Amount: $213,210,000.000

Vitru Ltd (VTRU)

Market: NASDAQ Global Select

Price: 22.00-24.00

Shares: 11,230,126

Offer Amount: $309,951,4560

American Well Corp (AMWL)

Market: NYSE

Price: 14.00-16.00

Shares: 35,000,000

Offer Amount: $644,000,000.000

Broadstone Net Lease, Inc. (BNL)

Market: NYSE

Price: 17.00-19.00

Shares: 33,500,000

Offer Amount: $731,975,0000

Pactiv Evergreen Inc. (PTVE)

Market: NASDAQ Global Select

Price: 18.00-21.00

Shares: 41,026,000

Offer Amount: $990,777,9000

Sumo Logic, Inc. (SUMO)

Market: NASDAQ Global Select

Price: 17.00-21.00

Shares: 14,800,000

Offer Amount: $357,420,000.000

9/18/2020

Unity Software Inc. (U) / NYSE

Market: NYSE

Price: 34.00-42.00

Shares: 25,000,000

Offer Amount: $1,207,500,000.000

Athira Pharma, Inc. (ATHA)

Market: NASDAQ Global

Price: 15.00-17.00

Shares: 10,000,000

Offer Amount: $195,500,0000

Top 25 Most Traded Stocks at Firstrade in August

Get the full list of top favored stocks and ETFs among Firstrade investors in the last month.

Firstrade investors once again favored tech stocks last month. The top stocks were Tesla and Apple, who both split their stocks on August 31st.

Here’s the full list:

Tesla Inc. (TSLA)

Apple Inc. (AAPL)

Nio Inc (NIO)

Advanced Micro Devices (AMD)

Taiwan Semiconductor Mfg. Co. Ltd. (TSM)

Microsoft Corporation (MSFT)

Boeing Co. (BA)

NVIDIA Corp. (NVDA)

Fastly Inc. (FSLY)

Intel Corporation (INTC)

Facebook Inc. (FB)

Square Inc. (SQ)

American Airlines Group (AAL)

Amazon.com Inc. (AMZN)

Moderna Inc. (MRNA)

Occidental Petroleum Corporation (OXY)

Carnival Corp. (CCL)

Teladoc Health Inc. (TDOC)

Alteryx Inc. (AYX)

Walt Disney Co. (DIS)

Bigcommerce Holdings, Inc. (BIGC)

Bank of America Corp. (BAC)

Alibaba Group Holding Ltd. (BABA)

Eastman Kodak Company (KODK)

Sea Ltd. (SE)

Apple and Tesla stock split: How does it work and how will it affect me?

Both Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) recently announced that they are splitting their stocks on August 31, 2020.

Apple announced a 4-for-1 stock split while Tesla announced a 5-for1 stock split. If you own either of these stocks, you will see the split price automatically reflected in your investment account on August 31st – there is no action required on your part and Firstrade does not charge any fees for stock splits.

If you currently own Apple or Tesla stocks or plan to buy any soon, here’s what else you need to know:

Both Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) recently announced that they are splitting their stocks on August 31, 2020.

Apple announced a 4-for-1 stock split while Tesla announced a 5-for1 stock split. If you own either of these stocks, you will see the split price automatically reflected in your investment account on August 31st – there is no action required on your part and Firstrade does not charge any fees for stock splits.

If you currently own Apple or Tesla stocks or plan to buy any soon, here’s what else you need to know:

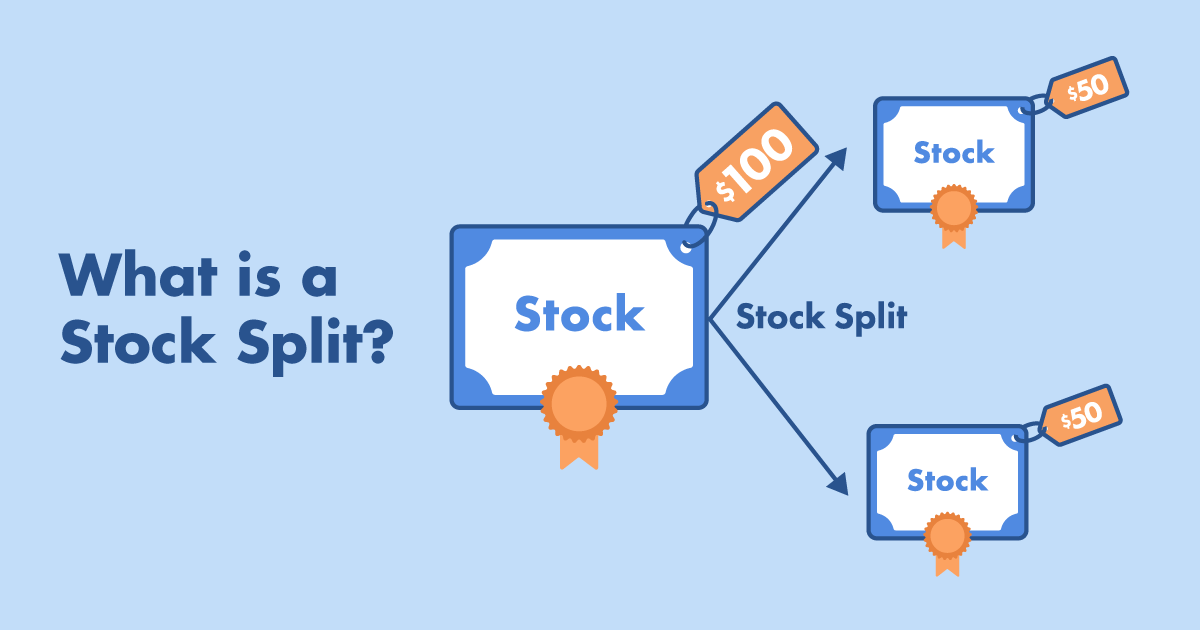

What is a stock split and how does it work?

A stock split is when a company decides to increase the number of its outstanding shares by dividing each share into multiple ones, reducing its stock price. This action doesn’t change the value of the company – just the price of its individual shares –which makes it more affordable for new investors to buy stocks in the company.

Take Apple (AAPL) as an example, for shareholders who already own Apple stocks, your original 1 share will become 4 shares, 2 shares will become 8 shares, and so on. The stock price will become 1/4 of the original price after the split, but its total market value would stay the same. Just like cutting an apple, no matter if you cut it into 4 or 8 slices, it will still be portions of the same apple.

Does the “record date” affect Apple or Tesla stocks in my account?

The record date of Apple (AAPL) has been marked as August 24 and Tesla (TSLA) as August 21. Regardless of the record date, all AAPL and Tesla shares you own before the market opens on August 31st will be entitled for the forward split share-allocation; you will own four shares of AAPL for every one share you hold, and five shares of TSLA for every one share you hold.

What will happen to the stocks in my account before and after the stock split?

Many people may be curious about what will happen if they choose to sell or buy the company’s stock before or after the stock split on August 31st. Let us again take Apple as an example, with $400/per share to illustrate the three scenarios that investors will encounter:

Scenario 1: If you hold Apple stock before the market opens on August 31st, it will be available to trade at the split price on August 31st.

The stock price per share after the split becomes ¼ of the original price. For example, if you have 10 Apple stocks valued at $400 per share, after the split, they will become 40 stocks valued at $100 per share. The total value of your Apple stock remains unchanged -- it’s still $4,000. After the market opens on August 31st, investors will be able to sell and buy Apple stocks at $100/per share.

Likewise, if you own one options call contract with a strike price of $500, after the split you would own four contracts controlling 100 shares each, at a $125 strike price.

Scenario 2: If you sell before August 31st, the stock you sold will be at the "pre-split" stock price.

Let’s say you sell Apple stock on August 28 (the last trading day before the split), you will be selling it at $400/per share instead of at $100 per share.

Scenario 3: If you buy Apple stock before August 31st, the stock you bought will be at the "pre-split" stock price.

If you buy 10 shares of Apple before August 31st, you will have 10 shares of Apple worth $400 per share in your account; on August 31st, due to the stock split, you will see Apple’s share price per share change from $400 to $100, and the number of shares you hold will change from 10 shares to 40 shares.

Firstrade's latest iOS app update has customers’ most-requested features

Firstrade’s iOS app v3.3.8 brings the following features to this release:

Group Positions

Positions can now be grouped by asset type (stocks, options, mutual funds, etc. each arranged alphabetically within the group) or alphabetically (with stocks grouped with the related options).

Firstrade’s iOS app v3.3.8 brings the following features to this release:

Group Positions

Positions can now be grouped by asset type (stocks, options, mutual funds, etc. each arranged alphabetically within the group) or alphabetically (with stocks grouped with the related options).

Volume column added to the Positions list

Trading volume for specific stocks or options are now added and shown in real-time as you scroll to the left. This new column helps you better understand the market situation and your investing direction.

Pull to refresh the Account Value chart

By pulling down the chart or position screen, you can view the refreshed Account Value/Balance/Portfolio right away.

If you don’t have the latest version of our app, you can get it here or scan this QR code to download it from the Apple App Store.

We hope you enjoy using our app, and we’d love to hear your feedback!

Firstrade's iOS App featured at Benzinga's Options Bootcamp

Firstrade was a guest on Benzinga’s Options Bootcamp last Friday, July 31st 2020. The virtual event featured options trading experts and was attended by thousands of investors of all levels of trading experience.

Firstrade was a guest on Benzinga’s Options Bootcamp last Friday, July 31st 2020. The virtual event featured options trading experts and was attended by thousands of investors of all levels of trading experience.

These events were created by Benzinga to spark innovation among the participating broker-dealers and to bring financial education to investors as they enter the markets.

Jeff Huang, CIO at Firstrade gave a demonstration of Firstrade’s updated iOS App and its new features for options investors. Besides the updated aesthetics, the new app lets options traders view more data in one screen and place/edit orders and close positions quickly, whether they are trading simple or complex options strategies. Read more about it here: Firstrade Has Released A Mobile Trading App That Makes Complex Trading Simple

Benzinga’s online bootcamps are a great resource for traders looking to improve their investing literacy and to learn more about the latest and greatest innovations available to them as they navigate the stock market.