Top 25 Most Traded Stocks by Investors at Firstrade in September

Get the full list of top favored stocks and ETFs among Firstrade investors in the last month.

Tesla Inc. (TSLA)

Apple Inc. (AAPL)

NVIDIA Corp. (NVDA)

Advanced Micro Devices (AMD)

Taiwan Semiconductor Mfg. Co. Ltd. (TSM)

Nio Inc (NIO)

Microsoft Corporation (MSFT)

Zoom Video Communications Inc (ZM)

Facebook Inc. (FB)

Amazon.com Inc. (AMZN)

Boeing Co. (BA)

Square Inc. (SQ)

AT&T Inc. (T)

Intel Corporation (INTC)

Carnival Corp. (CCL)

American Airlines Group (AAL)

Fastly Inc. (FSLY)

Peloton Interactive Inc. (PTON)

Nikola Corporation (NKLA)

Alibaba Group Holding Ltd. (BABA)

Exxon Mobil Corporation (XOM)

Workhorse Group Inc. (WKHS)

Beyond Meat Inc. (BYND)

Eastman Kodak Company (KODK)

Bank of America Corp. (BAC)

Trade Options with Confidence at Firstrade

Options are an important part of an investor’s toolbox, and Firstrade has partnered with OptionsPlay to give our clients access to a full suite of options analytics tools and weekly options education events for free.

Firstrade clients can access comprehensive education and analytics to help them learn and execute options with confidence. Options trading can carry a high amount of risk and the complexities can be daunting for many beginners – Firstrade aims to make it easier for investors to advance their options knowledge by teaching strategies with best practices in mind, and by providing trading reports and ideas that would work for any portfolio.

The Firstrade Options Wizard platform provides instant feedback and analysis for up to 3 different option strategies, side by side. With access to over 65 technical indicators, profit and loss simulations, 40+ complex strategies, strategy checklists and much more, this tool is a must-have for options investors of all experience levels.

Option Wizard, powered by OptionsPlay

This options strategy tool takes the complexity out of idea generation and options strategies analysis. With an interactive, easy to use user interface, investors can effortlessly compare different option strategies while adjusting for different price targets, implied volatility and expiry dates. The charting tool displays support and resistance zones, trend analysis and overbought/oversold levels and price action analysis to help you gauge the directional movement of a stock at a single glance.

Educational Webinars

Take your trading to the next level with our Bi-Weekly Educational Webinars. Join Tony Zhang, Chief Strategist at OptionsPlay and CNBC's Options Action Contributor, on Wednesdays at 4:15 PM EST to learn all options strategies, concepts and best practices. With topics ranging from Using Options to Hedge your Portfolio to Maximizing Technical Analysis for Security Selection, our educational webinars will help you get the most out of your trading! Register for the next education event here.

Weekly Market Outlook Sessions

Keeping up to date with what's happening in the markets is vital for an investor. Join us every Tuesday at 8:30 AM EST for the Weekly Market Outlook Session where Tony Zhang will catch you up to speed with the technical levels and economics that are impacting markets. We discuss the broad market overview, sector analysis, trade ideas and symbols of interest. You will also have the opportunity to ask Tony any questions you may have regarding the broader markets and trading strategies. These events are not to be missed so be sure to book your spot here.

Sign-up to get weekly trade ideas

For investors seeking income from their portfolios, options provide a unique opportunity to generate income on your equity investments through covered calls and cash secured puts. Receive OptionsPlay’s weekly optimized Covered Call and Short Put reports to understand the best income opportunities each week. Each income report will help you find the income strategy that is right for your portfolio by analyzing over 500 symbols' strike prices, expiration dates and implied volatilities. You will also receive 2 trade ideas - one bullish and one bearish, each week on Friday’s. Open an account and get access to our weekly options newsletter here.

Trade with Confidence

Whether you are a complete beginner, or an experienced options trader, we have the tools to help you learn and execute your trades with confidence. Learn how our award-winning platform can help you manage your portfolio by using options here.

Options trading involves risk and is not suitable for all investors. Options trading privileges are subject to Firstrade review and approval. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options.

Get ready for a lot of IPOs this week.

The IPO market hasn’t been this busy since 2014, with 16 companies expected to launch their IPOs this week. Planned proceeds are anticipated to be around $7.8 billion, which will be the biggest week since May 2019 when Uber went public.

The IPO market hasn’t been this busy since 2014, with 16 companies expected to launch their IPOs this week. Planned proceeds are anticipated to be around $7.8 billion, which will be the biggest week since May 2019 when Uber went public.

The list includes Snowflake Inc. (SNOW), a cloud company with a proposed price range of $100 to $110 for its initial public offering. The company is planning to offer 28 million shares to raise up to $3.08 billion, which would make it the biggest deal of the year and the largest software IPO of all time. Here’s the full list of IPOs expected from Sept 16-18.

9/16/2020

Snowflake Inc. (SNOW)

Market: NYSE

Price: 100.00-110.00

Shares: 28,000,000

Offer Amount: $3,542,000,0000

JFrog Ltd (FROG)

Market: NASDAQ Global Select

Price: 39.00-41.00

Shares: 11,568,218

Offer Amount: $545,441,450.000

StepStone Group Inc. (STEP)

Market: NASDAQ Global Select

Price: 15.00-17.00

Shares: 17,500,000

Offer Amount: $342,125,0000

Metacrine, Inc. (MTCR)

Market: NASDAQ Global

Price: 12.00-14.00

Shares: 6,540,000

Offer Amount: $105,294,0000

9/17/2020

Alpha Healthcare Acquisition Corp. (AHACU)

Market: NASDAQ Capital

Price: 10.00

Shares: 10,000,000

Offer Amount: $115,000,0000

Dyne Therapeutics, Inc. (DYN)

Market: NASDAQ Global

Price: 16.00-18.00

Shares: 10,300,000

Offer Amount: $213,210,000.000

Vitru Ltd (VTRU)

Market: NASDAQ Global Select

Price: 22.00-24.00

Shares: 11,230,126

Offer Amount: $309,951,4560

American Well Corp (AMWL)

Market: NYSE

Price: 14.00-16.00

Shares: 35,000,000

Offer Amount: $644,000,000.000

Broadstone Net Lease, Inc. (BNL)

Market: NYSE

Price: 17.00-19.00

Shares: 33,500,000

Offer Amount: $731,975,0000

Pactiv Evergreen Inc. (PTVE)

Market: NASDAQ Global Select

Price: 18.00-21.00

Shares: 41,026,000

Offer Amount: $990,777,9000

Sumo Logic, Inc. (SUMO)

Market: NASDAQ Global Select

Price: 17.00-21.00

Shares: 14,800,000

Offer Amount: $357,420,000.000

9/18/2020

Unity Software Inc. (U) / NYSE

Market: NYSE

Price: 34.00-42.00

Shares: 25,000,000

Offer Amount: $1,207,500,000.000

Athira Pharma, Inc. (ATHA)

Market: NASDAQ Global

Price: 15.00-17.00

Shares: 10,000,000

Offer Amount: $195,500,0000

Top 25 Most Traded Stocks at Firstrade in August

Get the full list of top favored stocks and ETFs among Firstrade investors in the last month.

Firstrade investors once again favored tech stocks last month. The top stocks were Tesla and Apple, who both split their stocks on August 31st.

Here’s the full list:

Tesla Inc. (TSLA)

Apple Inc. (AAPL)

Nio Inc (NIO)

Advanced Micro Devices (AMD)

Taiwan Semiconductor Mfg. Co. Ltd. (TSM)

Microsoft Corporation (MSFT)

Boeing Co. (BA)

NVIDIA Corp. (NVDA)

Fastly Inc. (FSLY)

Intel Corporation (INTC)

Facebook Inc. (FB)

Square Inc. (SQ)

American Airlines Group (AAL)

Amazon.com Inc. (AMZN)

Moderna Inc. (MRNA)

Occidental Petroleum Corporation (OXY)

Carnival Corp. (CCL)

Teladoc Health Inc. (TDOC)

Alteryx Inc. (AYX)

Walt Disney Co. (DIS)

Bigcommerce Holdings, Inc. (BIGC)

Bank of America Corp. (BAC)

Alibaba Group Holding Ltd. (BABA)

Eastman Kodak Company (KODK)

Sea Ltd. (SE)

Apple and Tesla stock split: How does it work and how will it affect me?

Both Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) recently announced that they are splitting their stocks on August 31, 2020.

Apple announced a 4-for-1 stock split while Tesla announced a 5-for1 stock split. If you own either of these stocks, you will see the split price automatically reflected in your investment account on August 31st – there is no action required on your part and Firstrade does not charge any fees for stock splits.

If you currently own Apple or Tesla stocks or plan to buy any soon, here’s what else you need to know:

Both Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) recently announced that they are splitting their stocks on August 31, 2020.

Apple announced a 4-for-1 stock split while Tesla announced a 5-for1 stock split. If you own either of these stocks, you will see the split price automatically reflected in your investment account on August 31st – there is no action required on your part and Firstrade does not charge any fees for stock splits.

If you currently own Apple or Tesla stocks or plan to buy any soon, here’s what else you need to know:

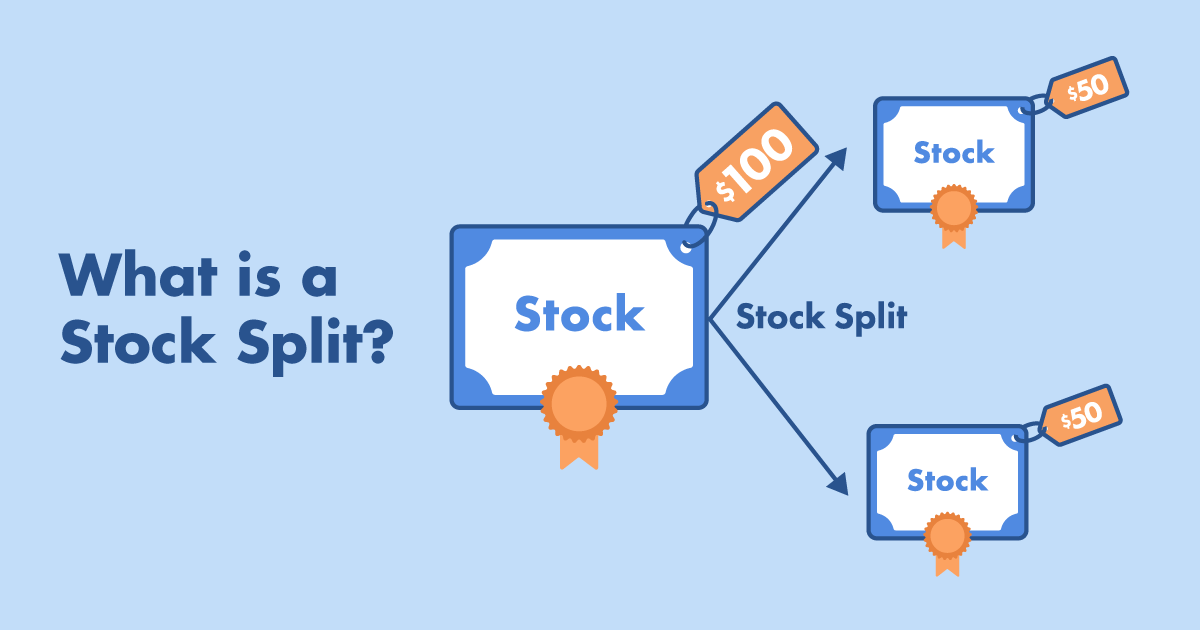

What is a stock split and how does it work?

A stock split is when a company decides to increase the number of its outstanding shares by dividing each share into multiple ones, reducing its stock price. This action doesn’t change the value of the company – just the price of its individual shares –which makes it more affordable for new investors to buy stocks in the company.

Take Apple (AAPL) as an example, for shareholders who already own Apple stocks, your original 1 share will become 4 shares, 2 shares will become 8 shares, and so on. The stock price will become 1/4 of the original price after the split, but its total market value would stay the same. Just like cutting an apple, no matter if you cut it into 4 or 8 slices, it will still be portions of the same apple.

Does the “record date” affect Apple or Tesla stocks in my account?

The record date of Apple (AAPL) has been marked as August 24 and Tesla (TSLA) as August 21. Regardless of the record date, all AAPL and Tesla shares you own before the market opens on August 31st will be entitled for the forward split share-allocation; you will own four shares of AAPL for every one share you hold, and five shares of TSLA for every one share you hold.

What will happen to the stocks in my account before and after the stock split?

Many people may be curious about what will happen if they choose to sell or buy the company’s stock before or after the stock split on August 31st. Let us again take Apple as an example, with $400/per share to illustrate the three scenarios that investors will encounter:

Scenario 1: If you hold Apple stock before the market opens on August 31st, it will be available to trade at the split price on August 31st.

The stock price per share after the split becomes ¼ of the original price. For example, if you have 10 Apple stocks valued at $400 per share, after the split, they will become 40 stocks valued at $100 per share. The total value of your Apple stock remains unchanged -- it’s still $4,000. After the market opens on August 31st, investors will be able to sell and buy Apple stocks at $100/per share.

Likewise, if you own one options call contract with a strike price of $500, after the split you would own four contracts controlling 100 shares each, at a $125 strike price.

Scenario 2: If you sell before August 31st, the stock you sold will be at the "pre-split" stock price.

Let’s say you sell Apple stock on August 28 (the last trading day before the split), you will be selling it at $400/per share instead of at $100 per share.

Scenario 3: If you buy Apple stock before August 31st, the stock you bought will be at the "pre-split" stock price.

If you buy 10 shares of Apple before August 31st, you will have 10 shares of Apple worth $400 per share in your account; on August 31st, due to the stock split, you will see Apple’s share price per share change from $400 to $100, and the number of shares you hold will change from 10 shares to 40 shares.